Testing consumer understanding

by Stuart Tayler. Published on 05 Jun 2023

Stuart Tayler

03 Jul 2023

In his recent webinar, ‘The Consumer Duty – a marathon or a sprint?’, our FS Strategy Director, Stu Charlton, discussed how retail Financial Services firms can drive the long-term mindset shift that the FCA requires. This abridged writeup outlines some of the key points that he made in the session.

Strategic Director

To hear the rest of the webinar, check out the video:

View video (The Consumer Duty – a marathon or a sprint?) on YouTube (with transcription)

31st July looms large for firms affected by the Consumer Duty. Maybe this is hard to hear just now, but it’s a deadline not a finish line. The FCA wants firms to permanently embed the Duty.

If you’re feeling the deadline heat, if you’re feeling stressed and weary already, our condolences. But I hope that you’ll find the following message energising.

Imagine that, only a few months from now, your Chief Commercial Officer parps something like this:

Through an exemplary focus on regulatory compliance and customer outcomes, we achieved improvements in commercial performance.

That’s what RAC’s Director of Acquisitions said after we helped his firm respond to a 2018 regulatory change. What we learned then is relevant today.

The regulator’s stated intent is to drive ‘a fundamental shift in industry mindset’ and ‘a change in culture at firms’. What kind of culture? It expects firms to ‘step up and put consumers at the heart of what they do’.

Can you think of a more dictionary definition of customer centricity?

By the way, truly customer-centred firms grow faster, change faster, and have happier employees. Those were the findings of the customer centricity study we led for Google.

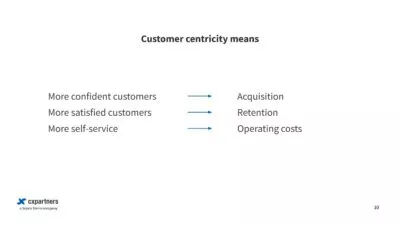

They see those business benefits because they excel at meeting customer needs. And when customers’ needs are met:

The regulator’s messages increasingly echo commercial strategists such as Google. They’re both pushing firms towards the same thing.

Customer-centricity delivers twin benefits in FS:

Hold that thought.

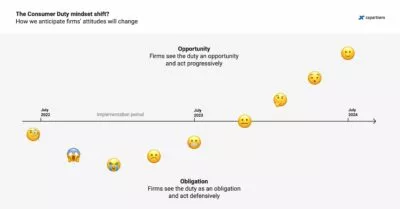

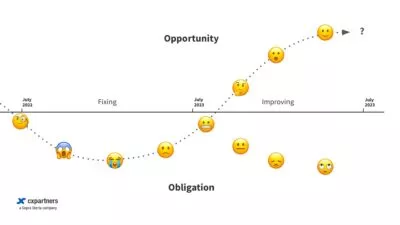

As the July implementation deadline passes a transition is needed. Ownership needs to shift from regulatory workstreams into marketing, product and service teams.

There’s jeopardy here. Momentum and focus will be lost if the teams who need to ‘act to deliver good outcomes’ have different objectives and personal motivations. Policies get ignored and forgotten. ‘Obligations’ are, at best, begrudgingly accepted and sink to the bottom of the priority list. That’s why – to transition successfully – we need to go with the grain of human behaviour.

So what motivates product and service teams? Primarily, it’s commercial KPIs. Happily, our decades of experience tells us that customer centricity reliably improves them.

HR teams know that employees increasingly also crave a clear sense of purpose. Customer centricity helps to provide that too. Octopus Energy were one of the top performers in our Google customer centricity study. Here’s how their co-founder accounts for their success:

Feeling that their daily work is contributing to something bigger than just a paycheck is the thing that helps deliver really outstanding customer results across the board.

Mission statements alone don’t motivate anyone. You need to make customer centricity feel real.

Qualitative user research is a powerful way to ‘put yourself in your customers shoes‘, as the FCA requires. It builds a clear connection between the humans that run businesses and the humans that they serve. Here’s how a CEO human reacted after watching some research that we led:

It’s been eye opening to see the end result and acknowledge how difficult we sometimes make things for our customers. […] Seeing that in one place creates a sense of urgency in our need to simplify things for our customers.

That makes it real. To embed the Consumer Duty – to make it a shared responsibility, to motivate product and service teams – we also need a shared language.

Let’s use the language of customer centricity rather than compliance.

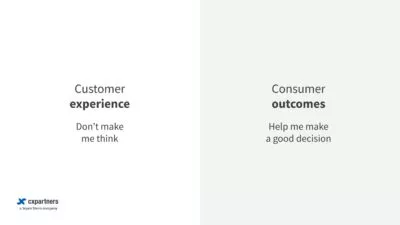

Let’s be specific with that language. In particular, avoid talking about customer experience if you mean customer outcomes. They’re related, but different.

If you need convincing that they’re different, think about the last time you had fun doing something you later regretted.

It will be tricky to communicate these nuances and set the right metrics, but it’s critical to get right. I heard it quipped that ‘even PPI scored well for NPS at first’.

You’ll also need to adopt the right methods.

So it’s not trivial, but we know this is all doable because we’ve already helped firms to do it. And as the deadline pressure subsides this conversation should be easier. We’ll be able to see that this obligation is actually a commercial opportunity.

Let’s broker that conversation now. Let’s frame this using language and KPIs that product teams understand.

Let’s talk about how – in practice – FS firms can harness this vague-sounding thing called customer centricity to both reduce regulatory risk and increase reward.

In the lead up to the July deadline the main action has happened within compliance projects. Projects though, come to an end. To embed the Consumer Duty into business operations let’s adopt the established principles of continuous improvement.

In this case, continuous improvement requires perfecting the customer feedback loop:

Your teams might legitimately say they’re doing these things already. So what might they need to do differently?

Firms are swimming in data about things like trade frequency and AUM, length of policy and number of claims, NPS and conversion rate, disposition codes for complaints.

Quantitative data is reassuringly numbery and an essential part of the customer feedback loop. But it’s insufficient because it leaves blind spots.

In my experience, the biggest blind spot in quantitative data is consumer understanding.

Example: I was told about a customer who was happy to pay a monthly ‘fee’ for their credit card. They thought it represented value for money and they were satisfied with the service. Unfortunately the card was free to use and they were actually being fined every month for late payments. Each fine had steadily eroded their credit score. That harm didn’t show up in NPS nor in complaints data, because the customer had no idea there was a problem.

Qualitative research is an effective way to spot unseen problems with consumer understanding. That’s how this story emerged. It fills the information gaps left by quantitative data and reveals foreseeable risks of harm.

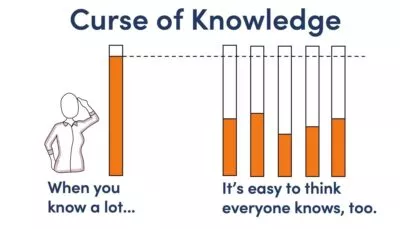

It’s also a potent remedy for the ‘curse of knowledge’, a mental glitch that tricks us all into thinking others know what we know.

Example: We led some research for a trading platform. It had spent heavily on ads to acquire new customers, but most prospects were dropping out during the onboarding journey. The product manager assumed that usability issues were the problem. However, our qualitative research revealed something different: their new customers fundamentally didn’t understand the products nor how to trade them.

The curse of knowledge was so entrenched in the Product Manager’s otherwise brilliant mind that he couldn’t compute what he was watching in the research.

I understand that CFDs are a bit different from what stock trading offers. But I don’t understand why it’s so complicated for the user to get familiar with it. Same two buttons, same graph, same list of markets 🤷♂️

Customers aren’t confused only by frisky trading products. Staples such as car insurance seem boggling to many. We see it all the time in user research. Much confusion is happening now in some of your customer journeys. Without rigorous qualitative research it’ll go undetected.

For those unsure what research methods you should use to test comprehension, our Practice Director, Stu Tayler, has some suggestions.

The ‘products and services’ outcome of the Consumer Duty requires that firms ‘ensure that the design of the product or service meets the needs, characteristics and objectives of customers in the identified target market.’

While most firms stockpile data about customer characteristics and behaviours, reliable data about needs, motivations and objectives is often thinner on the ground and tends to be patchy. Qualitative research reliably reveals insights that would otherwise remain hidden or misunderstood.

Example: A European startup had created a data model that identified expert investors using information about their holdings. They asked us to design tools that helped these sophisticated customers to choose new investments. But our qualitative interview techniques revealed that many had a poor understanding of investing. They were making decisions based on hunches, what their friends were doing, tips in newspapers, brand allegiances, family histories and a whole host of other unhelpful reasons.

The ‘sophisticated’ portfolios weren’t a reflection of customer expertise. Rather than advanced tools, these users needed more guidance. The firm’s strategy had been flawed because of this blind spot in their quantitative data.

Qualitative research plugs these information gaps, revealing hidden needs and risks of consumer harm that you’d otherwise miss.

So – rigorous qualitative research helps you listen better to customers. It’s an essential part of continuous improvement because it strengthens the first half of the customer feedback loop.

So far we described an open loop system. If we stopped there you’d make an informed guess, take action, then hope for the best. Sound familiar?

Many firms deploy changes intended to improve customer outcomes and never really find out whether they made things better or worse. They’re shooting into the dark. It’s done with best intent but firms risk wasting effort. And it won’t cut it in a Consumer Duty world – you’ll need to show how you acted to deliver good outcomes rather than how you paid due regard to them.

But we can fix this. Let’s look at two ways to close the loop and demonstrably improve customer outcomes sooner:

So many words have been spoken about the Consumer Duty that it’s easy to forget why we’re doing any of this. Let’s go back to the consultation paper from 2021:

Above all, this is all about priorities! Every firm has thousands of competing ones and – as we know – cost reduction and potential revenue are often the biggest drivers, especially within marketing, product and service teams.

To these teams, the pursuit of customer outcomes may appear to compete with the pursuit of cost reduction and revenue gains. We plan to establish that commerciality and compliance aren’t inevitably at odds. But sometimes, away from the marketing slogans, there’s legitimately a tradeoff.

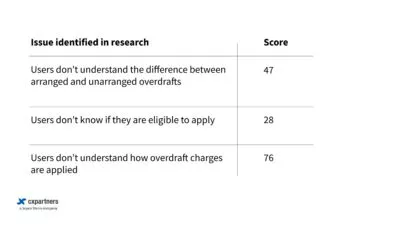

Here’s something that can help – it’s a way to prioritise problems using qualitative research insights. There’s more than one way to do it, this is just an example.

It starts with issues you’ve identified in user research. Each issue gets a score, with higher scores denoting higher priority. The range can be whatever you want. In our example it’s out of 100.

To create the score, criteria could include:

Some things to note:

There’s a lot more to say about this method, but I’ll leave you with this: it takes time in the near term, but saves you lots of time in the long run because it’ll help you avoid wild goose chases.

Use a method like this if you want to improve customer outcomes sooner and be able to show more credible rationale to the FCA.

For a more detailed explanation, watch the video on demand or drop me an email.

So – you’ve prioritised the right problems. Next, how do you get to the right solution soonest?

Rapid prototyping is the best method. To reduce the risk of failure, you place a small bet on a solution, to learn if it will work before staking the farm on it.

This isn’t a new idea of course, especially to product teams. So what are we suggesting they do differently?

Typically, we’re concerned with testing likely business outcomes. Is our solution desirable? Will they buy it? Will they sign up? Will it improve NPS? But now we also want to feel more confident about whether it will deliver better outcomes for customers. Will it improve understanding? Will it aid decision making? Does it have any unintended consequences?

Crucially, we can use rapid prototyping to avoid foreseeable risks of harm, especially to customers in vulnerable situations.

Example: When Samaritans asked cxpartners to help design their first-ever chat service it was clear that the level of trust would need to be exceptional. But trust is easy to get wrong and indeed when we tested our working Samaritans prototype before it launched, it revealed a hidden problem.

In a Consumer Duty world, there are dual benefits to rapid prototyping:

Teams need a slightly different mentality, and some different methods. And they need the confidence to explore counter-intuitive ideas, such as adding friction rather than removing it.

The ideas I’m sharing aren’t new or radical. I’m just joining the dots here.

It would be easy to lose momentum as ownership transitions into delivery teams. But if you seize the opportunity then better things are possible.

It’s very doable if you attack it with some intent. This feels like the moment, maybe the best opportunity you’ll get, to make your firm truly customer-centred and thrive.

by Stuart Tayler. Published on 05 Jun 2023

by Lauren Bailey. Published on 09 May 2023

by Tom Scott. Published on 25 Apr 2023

by Amy Bracewell. Published on 05 Apr 2023

by Jonti Dalal-Small. Published on 22 Mar 2023

by Stu Charlton. Published on 25 Nov 2024

by Stu Charlton. Published on 12 Sep 2024

by Stu Charlton. Published on 03 Nov 2023

by Stu Charlton. Published on 26 Sep 2023

by Lauren Bailey. Published on 06 Sep 2023