The problem we needed to solve

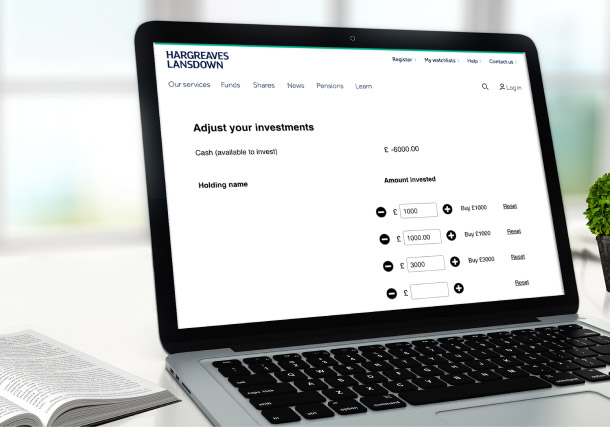

The Financial Conduct Authority had flagged an industry-wide problem: consumers moving into pension drawdown and keeping their funds in cash. Rather than reinvesting it to accrue further value, their pot risked shrinking if interest rates tracked below inflation.

As a remedy, the regulator had launched an initiative increasing the onus on pension providers to ensure that clients moving into drawdown could make better decisions.

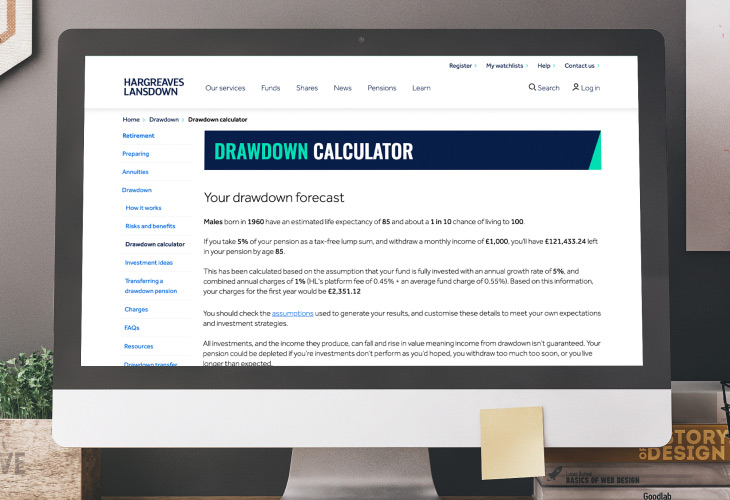

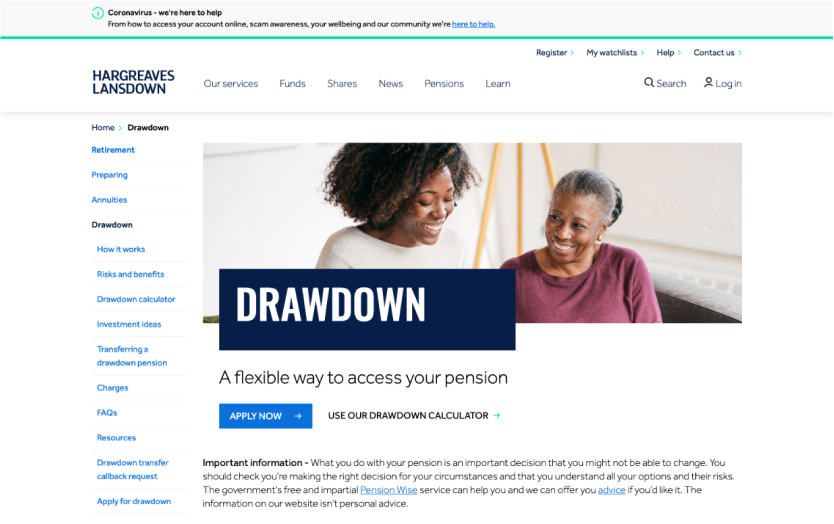

HL’s pension drawdown application process was paper-based, so the time was right to create an online journey.

Entering drawdown is a significant, irreversible life decision that most of us only get one shot at. That makes it a stressful decision, and stress impairs decision-making. To avoid adding increasing stress, the journey would need to feel easy to use.

But that didn’t feel like a problem. After all, most celebrated tales about UX involve making inconvenient things convenient, and difficult things easy.

There was a different, legitimate concern: making the online process too easy. If HL applied applied the 'don't make me think' approach that most UX follows, would clients lean more towards the instant gratification of tax-free lump sums, and less towards the longer-term returns the regulator wanted to see?

The unexpected test

Of course nobody knew then that HL would need to launch the journey during the pandemic that continues to harm our economy – pushing people into vulnerable situations.

It’s also driving short-term behaviours. The Money and Pensions Service has created a Financial Wellbeing Strategy that aims, among other things, to promote long-term thinking and create 'a nation of savers’. But coronavirus has other ideas. Research by the ABI showed that when restrictions were eased in September 2020, the number of people who withdrew all of their pension in one lump sum was 94% higher than the previous April, when the country had been in full lockdown.

Of course short-term behaviours aren’t always wrong. In this context, what is a good outcome for any given client? We shouldn't make assumptions.

It’s incumbent on financial services firms to rise to these challenges – to help consumers, not to make things harder for them. The regulator, the financial press and the markets are all watching intently.

And that’s just what we’re helping HL to do. While it was created before the current crisis hit, the journey we designed together is empowering HL clients to make informed decisions. And it’s standing up to an unexpected test.