22 Mar 2023

- Financial Services

Build a Consumer Duty culture using behavioural science – some simple steps

Financial services firms must strengthen plans to drive the “mindset shift” required by the FCA. Here’s a workshop to sow the seeds for a thriving Consumer Duty culture.

-

Jonti Dalal-Small

Behavioural Science Lead

In July, Jonti and Ed Smith (FCA’s Head Of Department, Retail Banking Supervision) discussed how firms can use behavioural science to prioritise good customer outcomes long after the implementation deadline has passed.

View video (Building a Consumer Duty culture – some simple steps) on YouTube (with transcription)

Did you know that the second-highest cause of death among firefighters is not wearing a seatbelt en route to an emergency? Or that trainee priests don’t stop to be a good Samaritan if they’re in a hurry?

When faced with urgent problems we risk neglecting other important matters. We’re wired that way.

Consider then, the anxiety within financial services firms seeking to comply with the Consumer Duty by July. We see many firms focusing on the urgent matters of updating policies and processes, fixing user journeys and making dashboards. These are hard, important yards and if you’re making progress then respect is definitely due. Except, it’s not enough.

The regulatory smoke signals increasingly spell out the need to permanently ‘embed’ the Duty rather than to comply with a set of one-off requirements. So let’s talk about another important but less-discussed matter: the “mindset shift” that the FCA wants to drive within the industry.

The Duty sets a higher expectation for the standard of care that firms give customers. For many firms, this will require a significant shift in both culture and behaviour, so they consistently focus on customer outcomes, and put consumers in a position where they can make effective decisions

A different approach is needed for the Consumer Duty because it’s based more on principles and less on rules than previous regulation. It requires employees – from the board down to frontline services – to exercise more judgement. Those humans are all fallible though and working under daily pressure.

The challenge for accountable execs is this: as July comes and goes, in the cut and thrust of day-to-day business, how can you trust that your staff will exercise good judgement?

The rivers you’ll need to cross

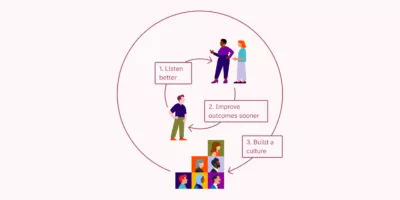

To embed the Duty you’ll need to make sure “all staff understand their responsibilities” before building some trickier bridges.

- The first one is from understanding to attitude (people in all roles should be “focused on delivering good outcomes for customers”). But you can’t stop there because “paying due regard” to fairness won’t cut it anymore.

- Next you’ll need to get from attitude to action (staff increasingly need to “act to deliver good outcomes” for customers). Proactivity and harm prevention are expected over reactivity and remediation.

This is about building a Consumer Duty culture.

Culture change can feel daunting – even more than building dashboards and other painfully complicated jobs that are at least knowable, familiar and measurable. That could be why, when it reviewed firms’ implementation plans, the FCA found that their culture and people strategies were notably thin.

It found..

…little explanation of the tangible actions that firms will take to ensure their people strategies are aligned with the new duty

And that many of the plans…

…gave no evidence of how their firm’s current purpose, culture and values do or do not align with the duty, or how those improvements would be made

Ignore these cues at your peril.

Culture doesn’t change overnight, but come July you’ll at least need to show the supervisor what you’re doing to help your staff to think and act differently.

What does ‘good’ look like?

To embed the Duty you’ll need to better align three things: your firm’s stated culture, how your employees behave, and the four Consumer Duty outcomes.

Use behavioural science to drive the right behaviours

We’re using behavioural science to help firms drive ethical behaviour, reduce regulatory risk, and improve their employee experience. Here’s an example:

A large bank launched an important and expensive new risk management system with much fanfare, but sponsors became confused when few of their staff used it. They asked us to drive adoption.

We defined addressable target behaviours, then led research to understand how and why they differed from current behaviours. We considered what enabled and blocked action, including:

- Elemental factors Are staff even aware of the system? Do they know how to use it?

- Psychological factors Why are they not motivated? Why are they fearful of using the system?

- Aspects of the wider environment For example, ingrained cultural norms that guide staff behaviours.

This multi-dimensional analysis revealed the context in which the once-shiny new system was gathering dust. And it made a murky challenge clear. We knew where to focus and which problems we’d need to solve.

With that insight, we could create a plan to systematically remove the blockers and amplify the enablers, and a toolkit that the team can use to design and test interventions, and ultimately scale those that work.

Try our diagnostic workshop

We’ve designed a 90-minute diagnostic workshop to make your Consumer Duty implementation plan actionable and robust.

What will it give me?

- Insights It will help you to identify where current behaviours within your firm support its Consumer Duty ambitions and where they present a barrier.

- A plan With those insights, you can start to build your backlog of ideas and make your Consumer Duty implementation plan significantly more actionable and robust. Culture change requires many, many small steps but with a concrete list of insights you can start to move forward with experiments to see what will really change behaviours in your firm.

How can I use it?

- Download our PDF worksheet. (Also available in Google slides and Miro.) It includes instructions describing what you’ll need and how to get started.

- Run a 90-minute workshop Change is, of course, best made with those affected, not done to them. It will feel empowering to your colleagues to co-design the change and focus on practical, lasting steps.

Questions to explore in the session

Culture:

- What is good and useful in your culture? What can you leverage to embed the Duty? e.g. Maybe you have a values framework that’s used for performance management.

- Where do you need to walk the talk? Where would acting in a way that’s consistent with your official culture help to embed the Duty? e.g. Perhaps your firm professes to be collaborative, but you aren’t really working together across silos to support customers.

Behaviour:

- Which of your practices are positive for the Consumer Duty outcomes? e.g. If your leaders are strong on accountability, this should be harnessed to deliver good outcomes for customers.

- Which practices are in tension with the Duty? e.g. does authority from your hierarchy stop people contributing and suggesting improvements?

Sow the seeds now for a thriving Consumer Duty culture

You may never have as much leverage as you do now to strengthen your firm’s culture. Although the clock is ticking, this could be the right moment to focus people’s attention on turning the Duty from an obligation into an opportunity to become more customer-centred and thrive.