The unseen problem of consumer confusion, and how to start fixing it

Here's a practical step to help financial services firms meet their Consumer Duty obligations, by improving consumer understanding.

–––

The FCA's Consumer Duty will raise the bar for consumer protection in FS retail markets. Firms will be required to more effectively anticipate and prevent consumer harm, and help customers meet their financial objectives.

The regulator expects more than best intent. The package of measures includes a new Consumer Principle that hardens the TCF requirement to “pay due regard” to customers' interests into action that will “deliver good outcomes” for them. And the suggestion is that you’ll need to get it right “first time”.

––––––

Join our free webinar on 12th July

Building a Consumer Duty culture – some simple steps

––––––

The FCA is talking boldly about driving "a fundamental shift in industry mindset" and "a change in culture at firms". It wants "all firms to be putting consumers at the heart of their businesses".

Can you think of a crisper definition of customer centricity?

To meet their obligations, firms will need to make systemic changes that improve their customer-centric maturity.

The scale of the challenge can feel overwhelming, so in the coming weeks we'll be sharing practical ideas about how you can work through these new requirements.

This article describes a simple, valuable step forward that you can take as part of your gap analysis. It begins with recognising the problem of consumer confusion.

–––

The ‘Consumer understanding’ outcome is a key pillar of the Consumer Duty.

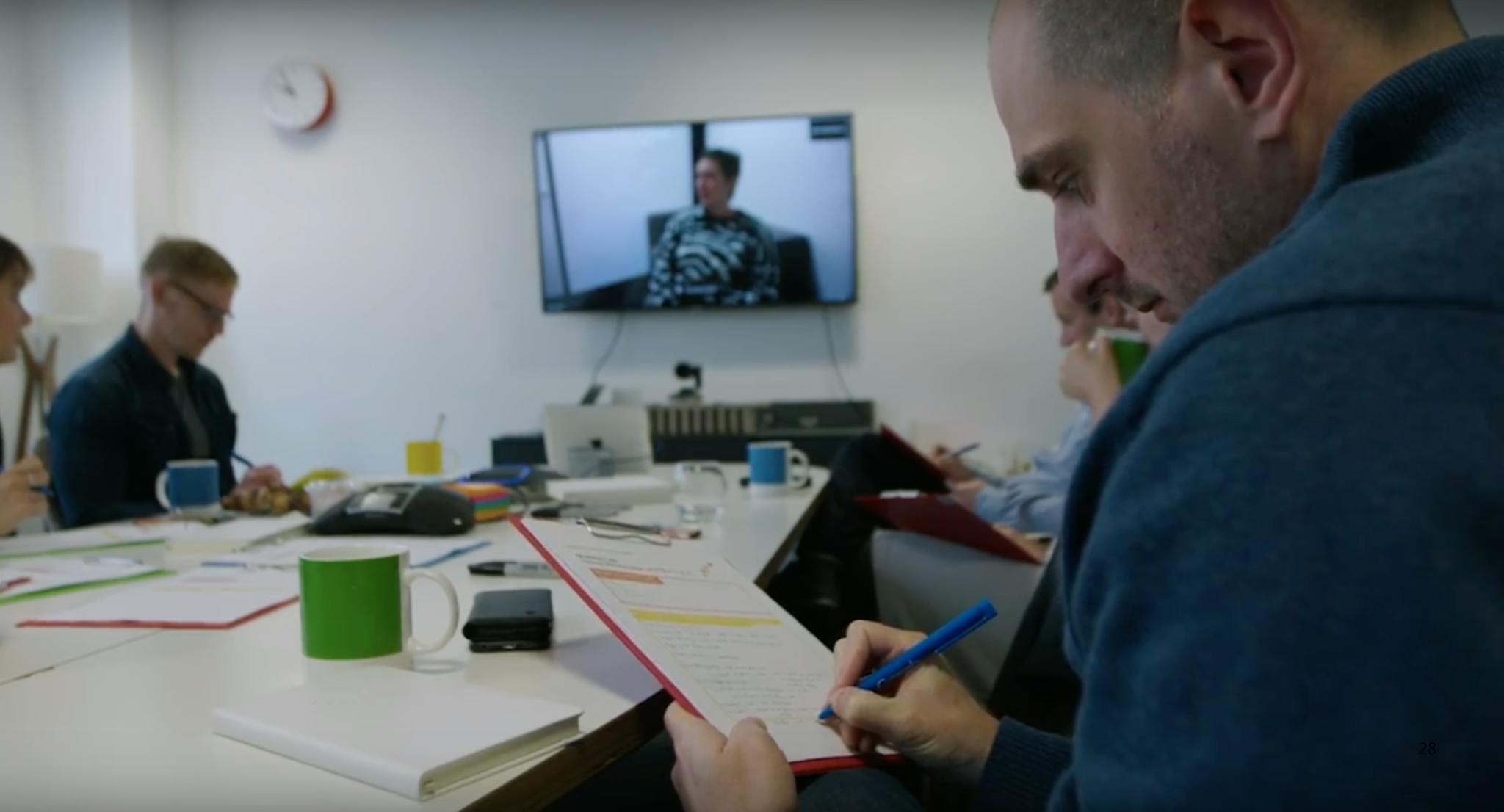

Talking to some firms you'd think that everything is fine, but we see something different in user research. Here's a participant choosing cover levels and add-ons for car insurance.

This is not my world! … I pressed ‘no’ for all of these. I didn't know what they were to be honest … It means nothing to me

Such confusion helps explain why trust remains low in the industry. (In the FCA's 2020 Financial Lives Survey, just 35% of participants agreed that financial firms are honest and transparent.)

Here's somebody buying travel insurance, with a known health condition and low expectations because of past experiences.

You need to pore over the nitty gritty, to try and work out what they'd link to my condition. I know they’ll try and get out of it. So it’s so hard to know – am I getting the cover I need? It feels like a bit of a gamble. I pick one and hope for the best.

It's not limited to insurance. We spoke to someone who'd recently switched their ISA to an ESG option on an investment platform that's known for providing a great user experience. This is what she told us:

I did zero research – it was too confusing – and just moved everything and whacked it on a high risk rating. It was easy because it’s all on the same platform.

This investor seemed buoyant when we spoke with her, but you wonder how long it will last. Rather than improving decision making, the rising tide of 'easy' user experiences instead simply delays that inevitable sinking feeling for many consumers across the sector.

Under the Consumer Duty, consumers will remain responsible for their own decisions. But only when the conditions are right.

Conditions today lead to many customers making poor decisions. What we see in research suggests that – regardless of how slick the user experience is – many are unlikely to get the positive outcomes everybody wants for them.

In the majority of cases it's unintentional. We work with dedicated professionals who take pride in helping their customers.

Firms don't fix the confusion when decision makers can’t see it. Fix the visibility problem and the rest will follow.

This blog describes the first of three steps you can take.

The first step: face up to consumer confusion and inspire action

To meet the Consumer Duty challenge, the regulator wants you to “put yourself in your customers’ shoes”.

Well-executed evaluative user research has three benefits.

- Understand the real challenge

It will provide an accurate picture of how your customers see and understand your journeys and products. It will reduce bias from your assessment and you'll begin to understand why what you are doing is broken (challenging pre-existing assumptions). - Inspire action

You might think that seeing confusion would lead to people getting negative about the state of play. But the opposite is true. When you watch people interacting with your services and hear their stories something magical happens: you empathise with them and it galvanises teams (often from across silos) to work together to solve the problems observed. - Fuel your cultural change

First-hand exposure to primary customer research fuels customer centricity like nothing else I've seen. It generates real stories that people in the organisation will immediately start sharing.

The skills you'll need

Ever had a great experience buying something you didn't need? Yup. Measuring ease of use alone won't help you to anticipate consumer harms or predict good outcomes for them. I recently heard Vodafone's Victoria Wickens quip that even PPI scored highly for NPS at first.

And many consumer vulnerabilities aren't immediately obvious. We've watched highly educated, professionally successful people make flawed decisions with supreme confidence. To really put yourself in your customers' shoes, you'll need skilled user researchers and research techniques that get inside the decision-making process.

Speaking with customers in a range of vulnerable situations will be key. You'll need to take extra steps to conduct that research safely and effectively. But it will be worth doing properly. It will give you a clearer, richer sense of how to meet your obligations to support them. And there's a bonus: it will reveal opportunities to make things better for all customers. For example, it will likely drive you to simplify.

Our recommendation

Commission specialist evaluative user research as part of your Consumer Duty gap analysis. If not now, when?

It will deliver a credible, independent assessment of the important problems to solve, and a sense of urgency.

Our prediction: those most accountable may be most surprised at what they see.

“It’s been eye opening to see how difficult we can make things for our customers. Seeing that joined together in one place creates a sense of urgency around how we can simplify things for our customers.”

Drop us a line

In coming weeks we'll be sharing practical ideas about how to build on this first step by systematically improving your visibility of consumer understanding. For an advanced view, drop me a line, stu.charlton@cxpartners.co.uk.

––––––

Update: our Practice Director, Stuart Tayler, has outlined some methods that we use to test consumer understanding

How use qualitative research to address the Consumer Understanding outcome

––––––