Testing consumer understanding

by Stuart Tayler. Published on 05 Jun 2023

Stuart Tayler

12 Jun 2023

Our recent research confirmed why investing in customer trust is both worthwhile and urgent. It makes your business resilient during turbulent times.

Claire Barrett

Senior UX Consultant

This is the first blog in our series on customer trust. We’ll pick apart this complex topic, helping you to build competitive advantage by deepening customer trust.

It’s both worthwhile and urgent. Trust makes your business resilient during turbulent times.

I recently led some qualitative research to better understand customer trust, by conducting one-to-one interviews and surveys with banking customers.

Our findings supported the idea that there’s a trust crisis. Trust in big institutions is low, especially in those that hold power such as government, media and business.

The customers we spoke with believed that big institutions were were ‘in it together’, controlling an unfair system.

I’m torn between who I trust the least because they’re all intrinsically linked.

Financial services did not fare well.

They’re all trying to control the system or the economy. And financial services are trying to control your money.

It’s conspiracy thinking maybe, but it would be unwise to dismiss the sentiment.

To rebuild trust, we need to first recognise the size of the challenge. The 2022 Edelman Trust Barometer suggested that distrust is now society’s default emotion:

Nearly 6 in 10 say their default tendency is to distrust something until they see evidence it is trustworthy.

It’s not a great picture. This is the moment in a future episode of Cautionary Tales when Tim Harford laments: “There were plenty of warning signs for firms paying attention. Most were not.”

Here’s the problem: if customers don’t trust your firm then you’re in jeopardy. A single regulatory change, competitor launch, or trust transgression could sink your business. Just ask Silicon Valley Bank.

There’s no emergency trust lever to pull when the iceberg hits. To stay relevant and resilient in turbulent times you need to consistently – methodically – build customer trust.

It’s especially urgent for Financial Services firms because it’s going to get easier for customers to jump ship.

So let’s look at where to start. There’s a clue in Edelman’s summary: the design challenge is to evidence your trustworthiness to customers.

When we redesigned The Co-operative Bank’s credit card marketing pages, we gave equal weighting to the positive and negative aspects of the product. Rather than recoiling at the sight of the overdraft charges, increasing numbers of people became customers.

There was information that they wanted to see, and we’d made it easy for them to see it. When we asked customers to use our prototypes they told us they found them ‘transparent’ and ‘reassuring’. That built trust, and when the new journey went live the transparent and reassuring designs made customers ready to buy. The bank had previously known where customers were dropping out of the funnel, but not why.

Our qualitative methods revealed the cause of the problem, the opportunity, and then the solution.

Trust is key to retention too. To illustrate how, let’s consider the factors that affect whether customers leave for a competitor’s product or service.

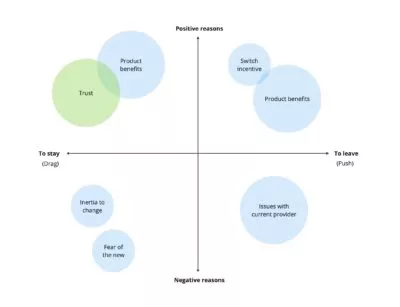

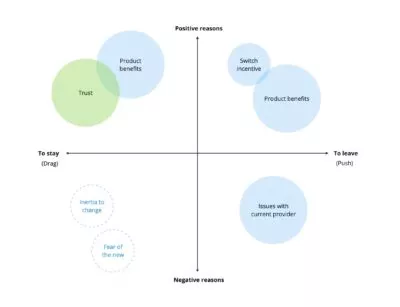

We can categorise these switching factors as positive or negative reasons for customers to stay ( ‘drag’ factors) or leave (‘push’ factors).

In our research we learned that some factors – including trust and product benefits – tend to have more influence. We’ve made those elements bigger. It shows that building trust is worthwhile because the positive drag factors exert more influence than the negative factors. Trust makes your business sticky!

Building trust is also urgent, because the Consumer Duty will further diminish the main negative drag factors. Let’s take a closer look at them.

If you rely on inertia and fear of the new for retention then your business is at risk.

Trust is your best defence. Customers with high levels of trust your firm have more positive reasons to stay, and so are less vulnerable to your competitors’ charms.

Trust is hard to build, yes, but that’s what makes it a superpower.

And we have the qualitative tools fit for the job – let’s use them to steal a march on your competitors, before they do it to you.

If you want to hear more about our research, or understand how customer trust is impacting your business then drop me a line – claire.barrett@cxpartners.co.uk – I’d love to chat.

How do you identify the situations when trust is most important to customers? We’ve identified three contextual factors that can help you decide where to focus your resources. Follow cxpartners on LinkedIn so that you don’t miss the next blog in our trust series.

by Stuart Tayler. Published on 05 Jun 2023

by Lauren Bailey. Published on 09 May 2023

by Tom Scott. Published on 25 Apr 2023

by Amy Bracewell. Published on 05 Apr 2023

by Jonti Dalal-Small. Published on 22 Mar 2023

by Stu Charlton. Published on 06 May 2025

by Stu Charlton. Published on 25 Nov 2024

by Stu Charlton. Published on 12 Sep 2024

by Stu Charlton. Published on 03 Nov 2023

by Stu Charlton. Published on 26 Sep 2023