We’re partnering with CFIT to explore the potential of Open Finance

Over the last six months we’ve been working with the Centre for Finance, Innovation and Technology (CFIT) as part of its Open Finance Coalition.

Open Finance is integral to the next phase of financial services innovation. To begin to realise its potential, CFIT launched this Coalition of partners from industry, academia, regulators and policymakers. We’re bringing diverse viewpoints to the challenge, exploring the technology, frameworks, standards and policy changes needed to drive forward meaningful change.

We’re excited to be working with some of the UK’s most brilliant minds, aiming to make our financial ecosystem more inclusive.

What is Open Finance?

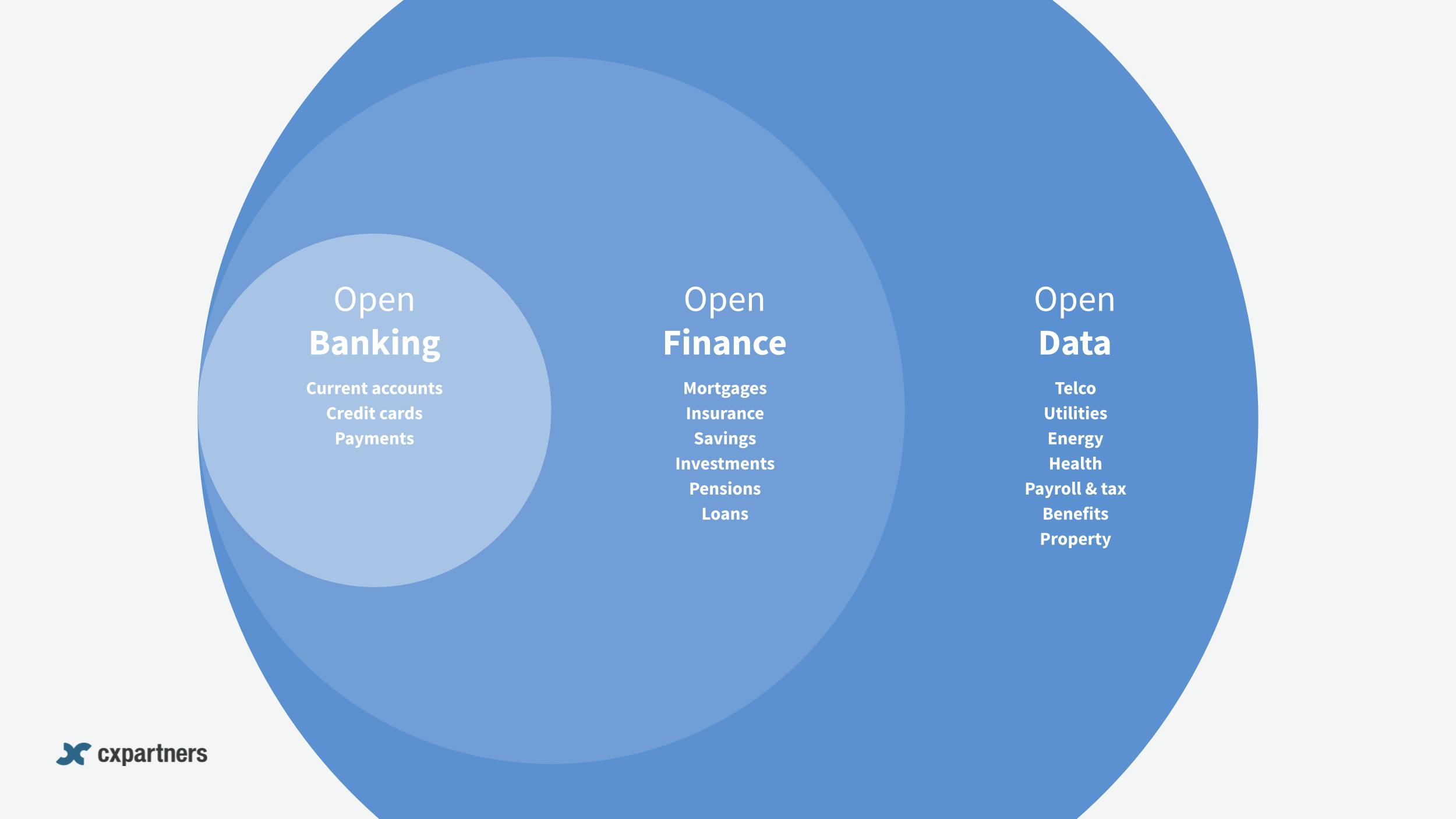

Open Finance is the next step in financial services innovation, building on what Open Banking started.

- Open Banking introduced the idea of securely sharing customer data with trusted third parties.

- Open Finance takes this idea further by including different types of financial information like savings, pensions, investments, insurance, mortgages, and other important aspects of personal finance.

The potential payoff

There are theoretical benefits for consumers (including those that most need help), industry and the wider economy.

Open Finance could give consumers more control and visibility of their finances. They could get a full picture of their financial information, which may help them make better decisions and access new services that suit their needs. Third-party providers could also use this wider range of data to offer personalised solutions that are different from traditional banking services. It could change how people manage their money and use financial products.

Some key questions to answer now

But that’s a lot of ‘coulds’.

It’s fair to say there's lots of uncertainty to resolve before we strike gold. There’s a risk that we focus narrowly on technical uncertainty and overlook the most important and unpredictable components in this system: the people who will use it. CFIT's CEO knows this.

If you forget the consumer, what is the point of doing all this? Because it is consumers that have to adopt these products

But we need to do more than 'remember' the consumer. There’s a clear risk that we assume that we already know what other people want and need, then leap to solutions.

If you ask someone if they need another dashboard you're not asking the right questions. Skilled user researchers understand how to elicit consumers' needs and motivations, and to learn about the barriers they face getting things done.

If we get that right now, it will save everyone time and effort.

Our coalition's theme: financial inclusion

At cxpartners, our mission is “to make organisations more resilient and more valuable by solving the biggest problems facing society today: sustainability, uncertainty, and equality”.

Financial exclusion is one of those societal problems, because financial services are essential services. To get by – to be safe, secure, and happy – people in all parts of society need to pool risk, to buffer themselves from life’s twists and turns, and to invest in their own future.

If you are outside the financial system or cannot access credit or insurance, you’ll find it harder to get back on your feet when things go wrong. Those sudden expenses of a car or appliance failing, of a burglary or accident, can blow people off course and even out of work.

Open Finance has the potential to address these problems. If we approach it right, we’ll be able to use emerging sources of personal data to deliver better financial outcomes for people that most need support.

Our initial focus

As a member of CFIT’s Consumer Design working group, we’ve focused on two opportunity areas: increasing access to debt support and making finance fairer. That work will be published in the coming months - stay tuned to hear more about it.

Let's chat

It's thought-provoking work and at this early stage it's generating questions and ideas in equal measure!

So if you're also exploring Open Finance then I'd love to swap stories and ideas. Drop me a line: tom.scott@cxpartners.co.uk